Investing is no longer something only experts or wealthy people do — it has become a skill everyone can learn and benefit from. In 2026, the world of investing is more accessible than ever, with easy-to-use platforms, educational tools, Beginner Investing Tips for Long-Term Wealth

Beginner Investing Tips for Long-Term Wealth But even with all these opportunities, many people still feel overwhelmed when starting. The good news? Successful investing doesn’t begin with complicated strategies — it begins with simple, smart decisions made consistently.

This beginner-friendly guide breaks down the most effective investing tips to help you build long-term wealth, avoid unnecessary risk, and create a strong financial foundation.

🟦 1. Understand That Time Is Your Most Valuable Investment Tool

You don’t need to be rich to start investing — you just need time.

Beginner Investing Tips for Long-Term Wealth ,Even small amounts invested consistently can grow exponentially thanks to compound interest, which allows your money to earn more money automatically over time.

You May Also Read Best AI Tools for Content Creators in 2026

Why starting early matters

-

Your investment has more years to grow.

-

You benefit from exponential compounding.

-

You can invest smaller amounts and still reach big goals.

The key is not perfection — it’s starting as soon as possible.

🟦 2. Choose Your Financial Goals Before You Invest

Every successful investor starts with clarity.

Ask yourself:

-

What am I investing for?

-

Do I want long-term security or short-term gains?

-

How much risk can I tolerate?

-

When will I need this money?

Common beginner goals

-

Retirement savings

-

Buying a home

-

Emergency cushion

-

Education

-

Future financial freedom

Your goals determine your investment plan, risk level, and asset choices.

🟦 3. Build an Emergency Fund Before Investing Heavily

An emergency fund protects you from unexpected financial surprises — and prevents you from withdrawing investments during market downturns.

How much should you save?

Most financial experts recommend 3–6 months of living expenses.

This is your financial safety net, making you a more confident and stable investor.

🟦 4. Start With Beginner-Friendly Investment Options

When you’re new to investing, simple assets are your best friend. They’re safer, easier to understand, and offer reliable long-term growth.

Beginner-friendly investment types

-

Index Funds → Track entire markets

-

ETFs → Affordable, diversified, low risk

-

Blue-chip stocks → Trusted, stable companies

-

Government bonds → Very low risk

-

High-yield savings or money market accounts

These are ideal for building a strong, low-risk financial base.

🟦 5. Diversify Your Portfolio to Reduce Risk

Diversification protects your money.

Instead of investing everything in one stock or asset, spread your investments across multiple places. This way, if one investment underperforms, others may still grow.

Simple ways to diversify

-

Invest in index funds (instant diversification)

-

Mix stocks, bonds, and ETFs

-

Include different sectors or industries

-

Hold both short-term and long-term investments

A balanced portfolio is safer and more stable.

🟦 6. Use Index Funds and ETFs for Easy, Low-Cost Growth

Index funds and ETFs are considered the best beginner investments because they’re simple, low-cost, and historically profitable.

Why beginners love them

-

They include hundreds of companies at once

-

They have lower fees than most funds

-

They reduce individual company risk

-

They require almost zero market knowledge

Investing doesn’t have to be complicated — and these funds prove it.

🟦 7. Avoid Emotional Decisions — Stick to Your Strategy

Markets rise and fall constantly. Beginners often panic during downturns and sell at the worst possible moment — or buy based on hype.

Avoid these common mistakes

-

Selling during a short-term drop

-

Buying just because a stock is trending

-

Trying to “time” the market

-

Following social media hype

The best investors stay rational, patient, and long-term focused.

🟦 8. Invest Consistently Using Dollar-Cost Averaging

One of the easiest ways to invest is to contribute a fixed amount regularly — weekly, biweekly, or monthly.

This strategy is called dollar-cost averaging (DCA).

Benefits of DCA

-

You don’t need to predict market highs or lows

-

You minimize timing risks

-

Your investments grow steadily

-

It builds discipline

Over time, this consistent strategy outperforms emotional, inconsistent investing.

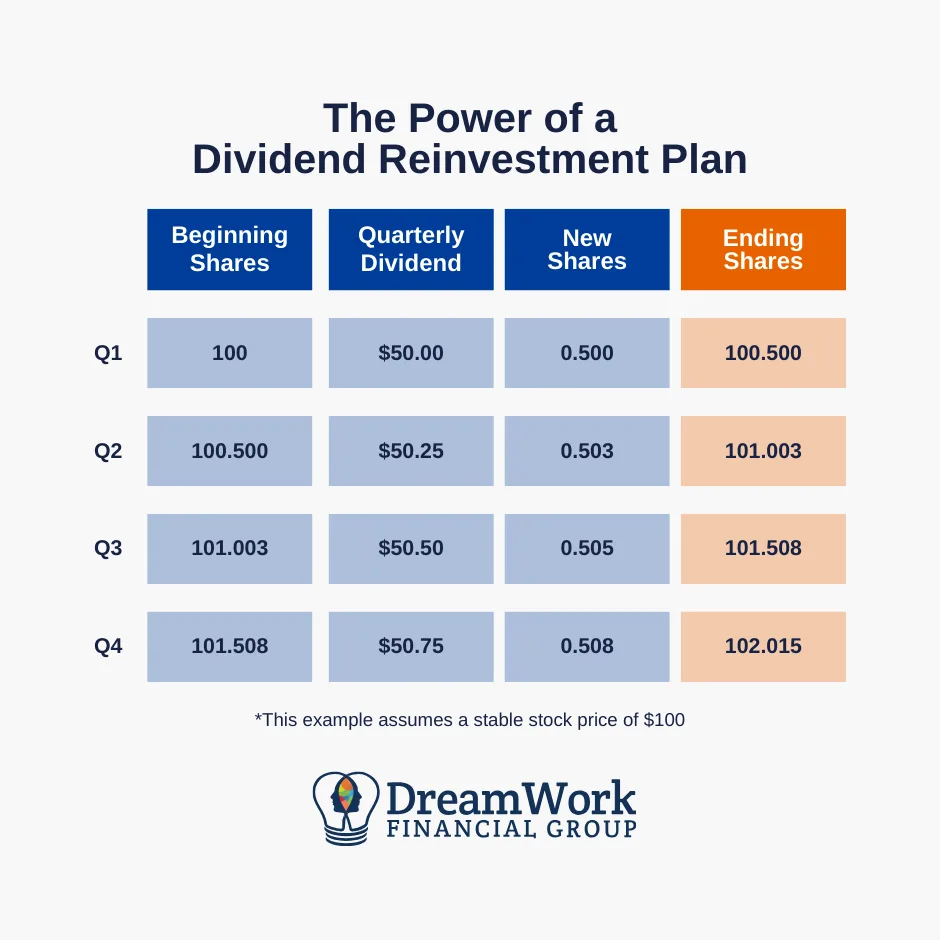

🟦 9. Reinvest Dividends and Earnings Automatically

Most investments generate returns such as:

-

Dividends

-

Interest

-

Capital gains

Reinvesting these automatically boosts the power of compounding.

It’s like adding fuel to your investment engine without lifting a finger.

🟦 10. Protect Yourself With Smart Risk Management

Risk isn’t something to fear — it’s something to manage.

Smart risk rules for beginners

-

Don’t invest money you need immediately

-

Don’t bet everything on one stock

-

Keep part of your portfolio in safer assets

-

Always stay within your risk tolerance

Great investors don’t chase risky opportunities — they protect their wealth.

🟦 11. Choose Low-Fee Investments to Maximize Your Returns

Fees may seem small, but over time, they can significantly reduce your gains.

Look for investments with:

-

Low expense ratios

-

Low (or zero) brokerage commissions

-

No hidden management fees

The lower your costs, the more of your earnings you keep — and long-term investors benefit the most.

🟦 12. Embrace Long-Term Investing for Serious Wealth Building

Long-term investing beats short-term trading almost every time.

Benefits of long-term investing

-

More predictable growth

-

Lower taxes

-

Less emotional stress

-

Market downturns become opportunities

-

Compounding becomes extremely powerful

Time in the market is more important than timing the market.

🟦 13. Keep Learning — Even Small Lessons Make a Huge Impact

Investing isn’t a one-time action — it’s a lifelong skill.

What beginners should learn gradually

-

How markets work

-

Different asset classes

-

How to read basic charts

-

Understanding financial risk

-

Building smart money habits

Education is the most valuable investment you’ll ever make.

⭐ Final Thoughts — Your Wealth Journey Starts Today

You don’t need to be wealthy, experienced, or lucky to become a successful investor. You just need:

-

The willingness to start

-

A simple strategy

-

Consistency

-

Patience

-

And long-term focus

Start small. Stay committed. Let time and compounding do the heavy lifting.

Your financial future is built one smart step at a time.

Pingback: Affiliate Marketing for Beginners: Step-by-Step Guide - Nxtainews