Managing money can feel stressful — especially when expenses keep increasing and income feels limited. Many people live paycheck to paycheck not because they earn too little, but because they don’t have a clear plan for their money.

That’s where a monthly budget comes in.

A budget helps you:

-

Track your spending

-

Control unnecessary expenses

-

Save money consistently

-

Avoid debt

-

Achieve financial goals

In this complete beginner-friendly guide, you’ll learn how to make a monthly budget step by step, even if you’ve never budgeted before.

🔹 What Is a Monthly Budget?

A monthly budget is a simple plan that shows: What is a budget?

-

How much money you earn

-

How much you spend

-

How much you save

It helps you decide where your money should go instead of wondering where it went.

Budgeting does not mean living a boring life. It means using your money wisely.

🔹 Why Creating a Monthly Budget Is Important

Here’s why budgeting is essential:

✔ Helps you control spending

✔ Reduces financial stress

✔ Builds saving habits

✔ Prepares you for emergencies

✔ Helps achieve financial goals

✔ Prevents unnecessary debt

Without a budget, it’s easy to overspend without realizing it.

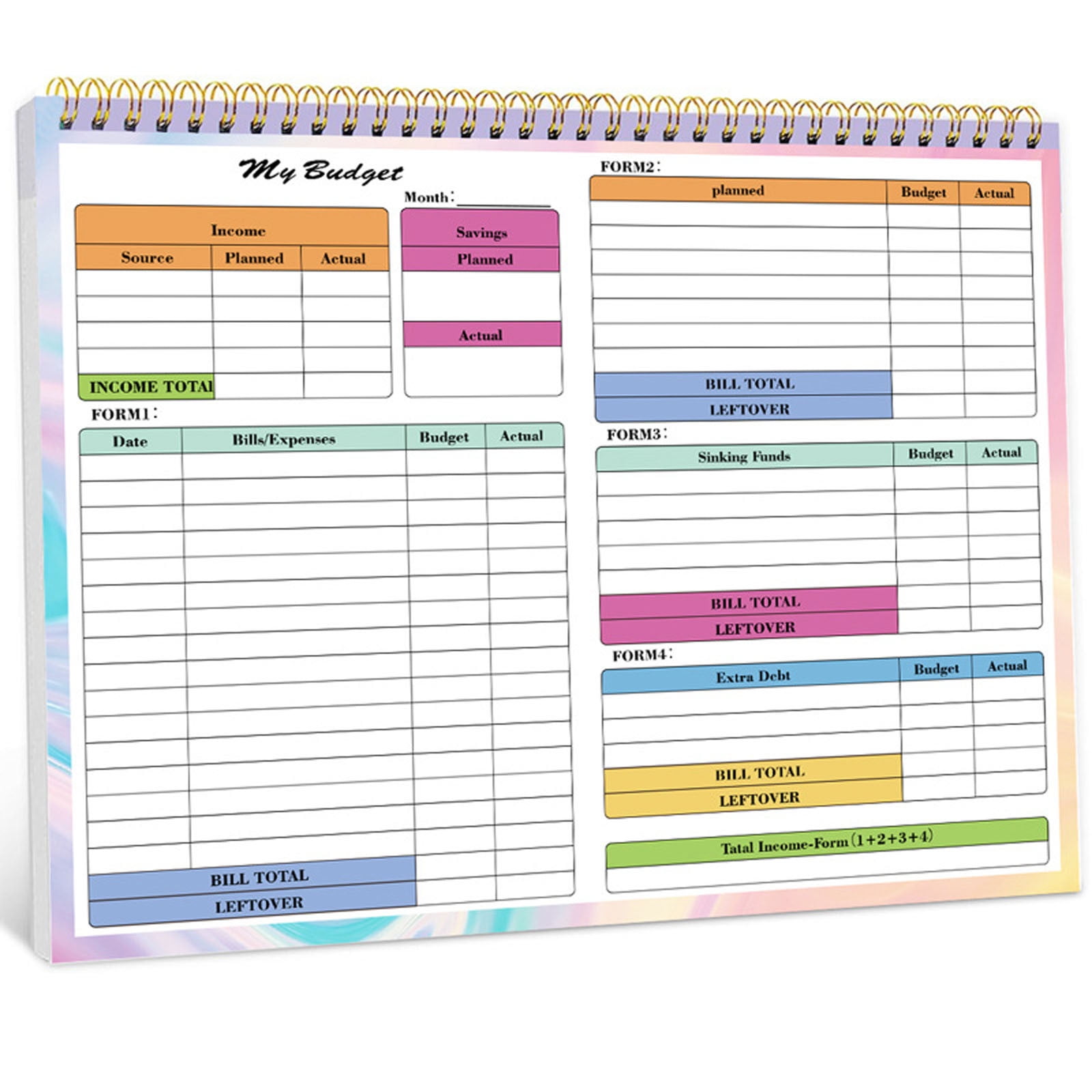

🔹 Step 1: Calculate Your Monthly Income

The first step is knowing exactly how much money you earn every month.

Include:

-

Salary (after tax)

-

Freelance income

-

Business income

-

Side hustle earnings

-

Any fixed monthly income

💡 Tip: Always calculate your net income, not gross.

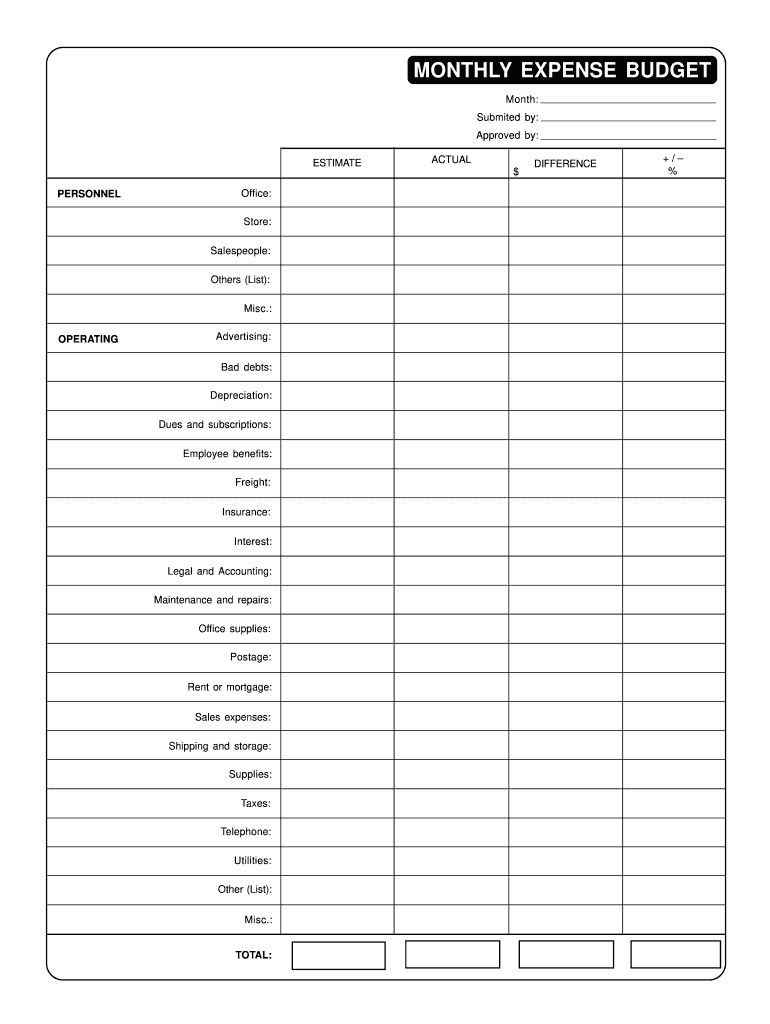

🔹 Step 2: List All Monthly Expenses

Write down every expense, even small ones.

Fixed Expenses:

-

Rent / Mortgage

-

Electricity & water

-

Internet & phone

-

Insurance

-

Loan payments

Variable Expenses:

-

Groceries

-

Transportation

-

Eating out

-

Shopping

-

Entertainment

Occasional Expenses:

-

Medical bills

-

Repairs

-

Gifts

-

Travel

Being honest here is very important.

🔹 Step 3: Categorize Your Spending

Now divide your expenses into categories. How to create a budget

A simple method is:

🟢 Needs (50%)

-

Rent

-

Food

-

Bills

-

Transport

🟡 Wants (30%)

-

Shopping

-

Entertainment

-

Eating out

🔵 Savings (20%)

-

Emergency fund

-

Investments

-

Future goals.l

This is called the 50/30/20 rule, and it works great for beginners.

Best Kubernetes Security Practices & Tooling 2026

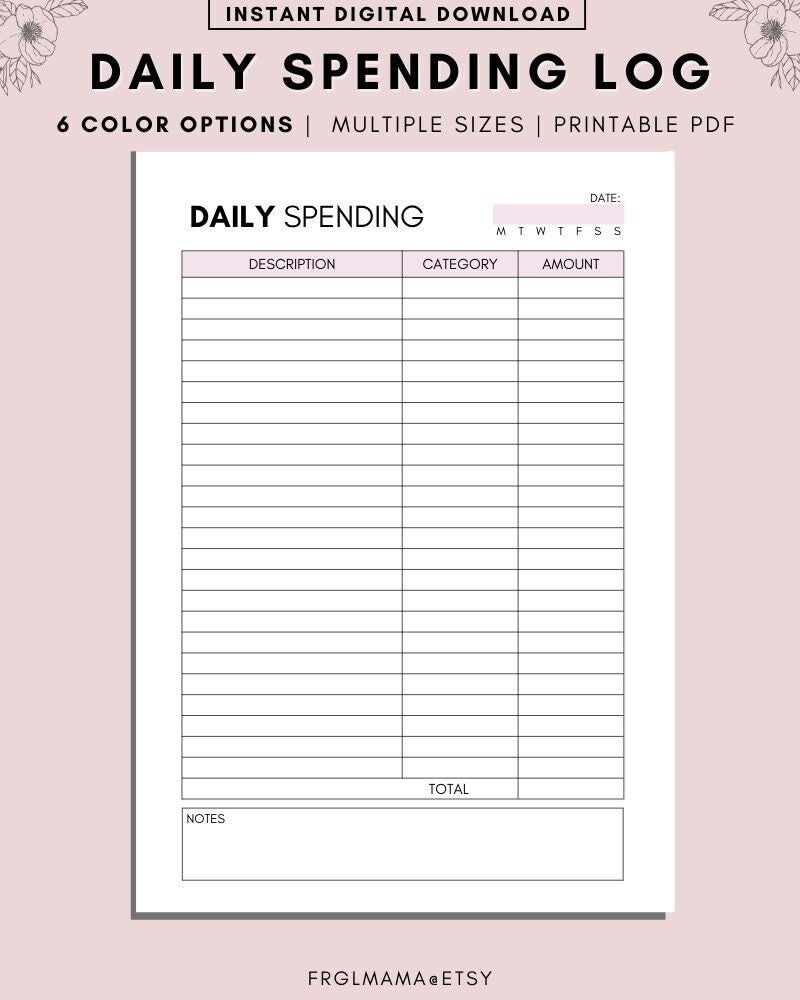

🔹 Step 4: Track Your Daily Spending

Tracking is the most important part of budgeting.

You can track expenses using:

-

A notebook

-

Spreadsheet

-

Budgeting apps

-

Notes app on your phone

Track:

✔ Every purchase

✔ Every bill

✔ Every small expense

You’ll be surprised how much money leaks out unnoticed.

🔹 Step 5: Set Realistic Financial Goals

Your budget should support your goals.

Examples:

-

Save $5,000 in a year

-

Pay off debt

-

Build emergency fund

-

Save for vacation

-

Buy a car or house

Break big goals into small monthly targets to stay motivated.

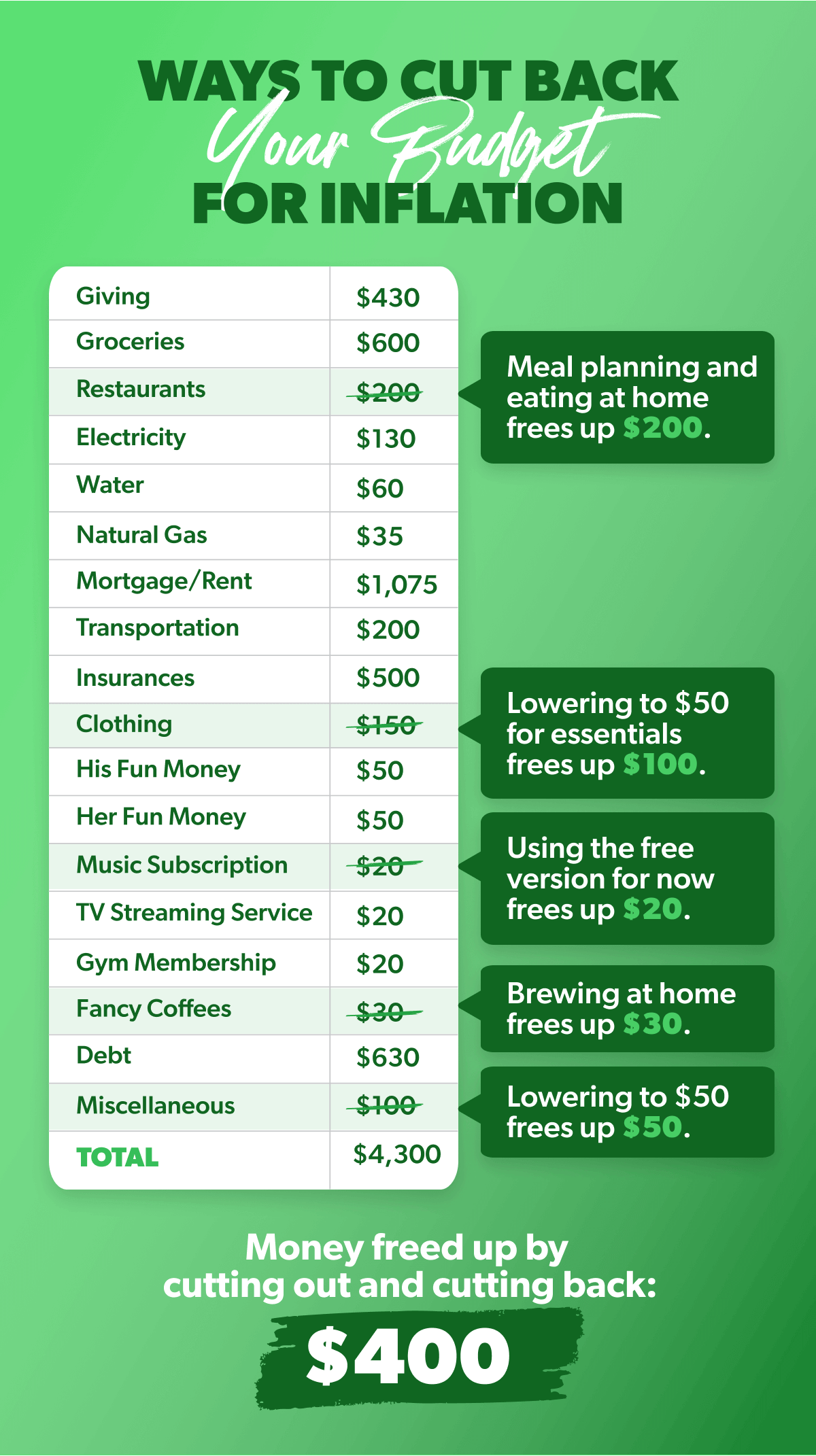

🔹 Step 6: Cut Unnecessary Expenses

Once you track spending, you’ll see where money is wasted.

Common areas to cut:

-

Subscriptions you don’t use

-

Frequent eating out

-

Impulse shopping

-

Expensive coffee habits

Small savings every day = big money over time.

🔹 Step 7: Create an Emergency Fund

An emergency fund protects you from:

-

Job loss

-

Medical emergencies

-

Unexpected repairs

Try to save at least:

💰 3–6 months of living expenses

Start small — even saving a little each month helps.

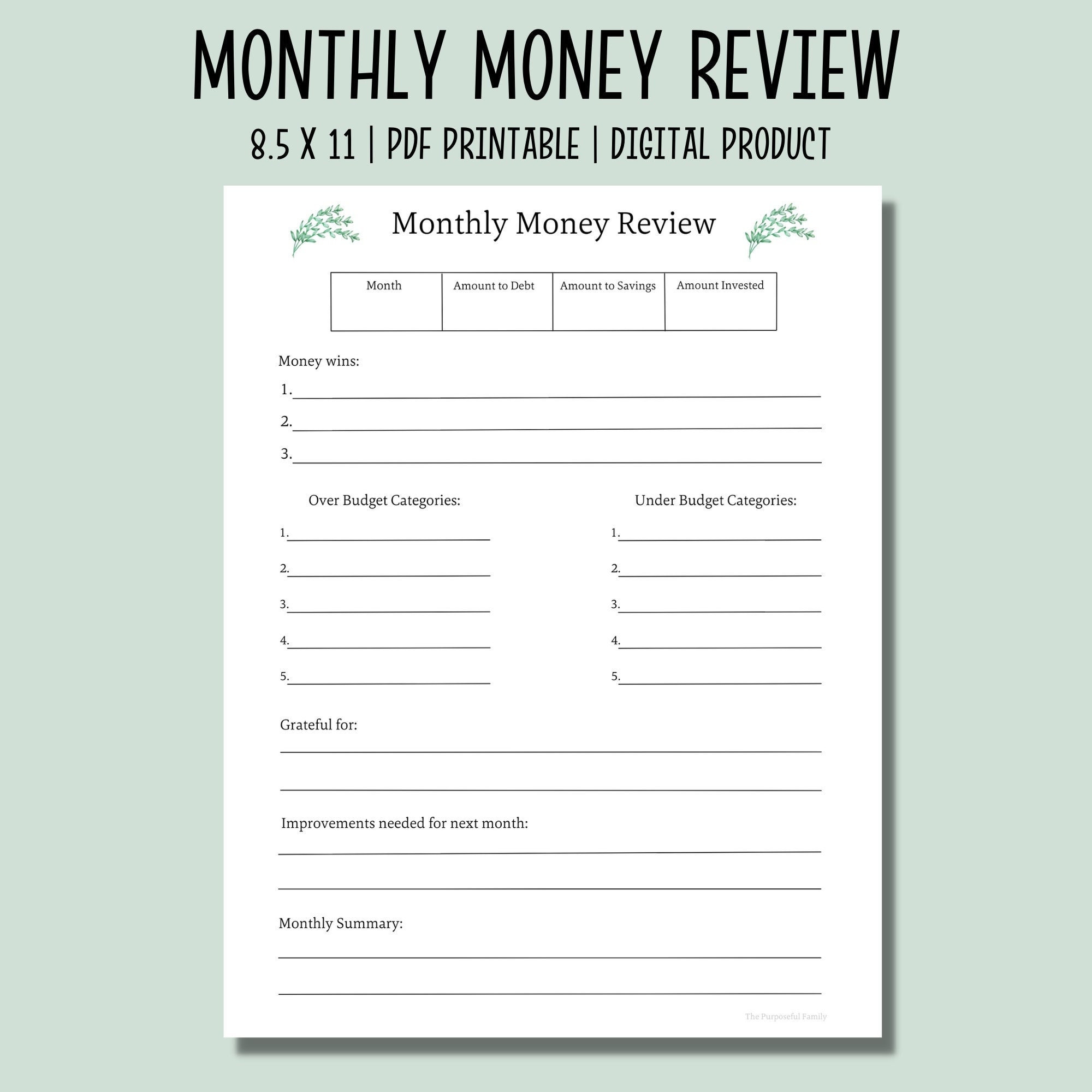

🔹 Step 8: Review and Adjust Your Budget Monthly

Your budget is not fixed forever.

Every month:

-

Review expenses

-

Adjust categories

-

Improve savings

-

Remove unnecessary spending

A good budget grows with your lifestyle.

🔹 Step 9: Use Budgeting Tools (Optional)

You can manage your budget using:

-

Google Sheets

-

Excel

-

Budgeting apps

-

Personal finance notebooks

Choose what feels easiest. Simplicity always wins.

🔹 Step 10: Stay Consistent and Patient

Budgeting is not about perfection.

You may fail some months — that’s okay.

What matters:

✔ Consistency

✔ Discipline

✔ Long-term focus

Over time, budgeting becomes a habit that changes your financial life.

🌟 Final Thoughts

Creating a monthly budget is one of the most powerful financial habits you can develop. It helps you stay in control, reduce stress, and achieve your goals faster.

You don’t need to be rich to start budgeting — you need discipline and a plan.

Start today, even with a simple budget. Your future self will thank you.

Pingback: How to Build an Emergency Fund (Step-by-Step Guide for Beginners) - Nxtainews