Life is unpredictable. One unexpected expense — a medical bill, job loss, car repair, or emergency travel — can completely disrupt your finances if you’re not prepared.

That’s why building an emergency fund is one of the most important financial steps you can take.

In this guide, you’ll learn exactly how to build an emergency fund step by step, even if you’re living paycheck to paycheck. This article is beginner-friendly, practical, and designed to help you gain financial security without stress.

🔹 What Is an Emergency Fund?

An emergency fund is money set aside only for unexpected situations, such as:

-

Medical emergencies

-

Job loss

-

Urgent home repairs

-

Car breakdowns

-

Family emergencies

This money is not for shopping, vacations, or entertainment.

It is your financial safety net.

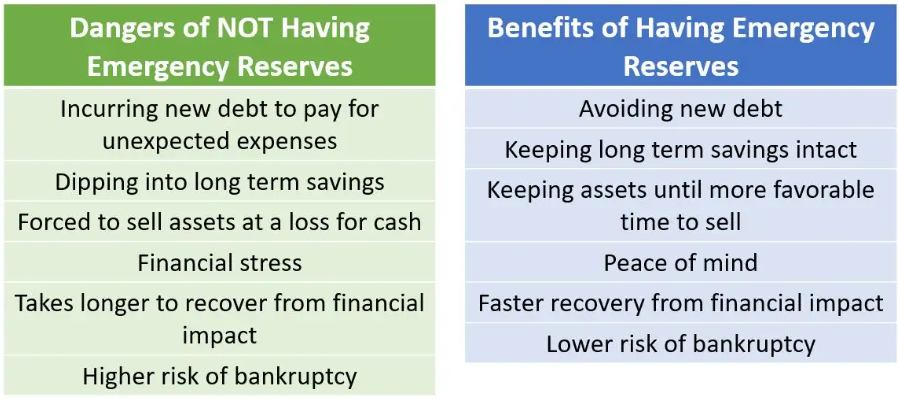

🔹 Why an Emergency Fund Is So Important

Without an emergency fund, people usually:

-

Go into debt

-

Use credit cards

-

Borrow money

-

Panic during financial stress

With an emergency fund:

✔ You stay calm

✔ You avoid debt

✔ You stay financially stable

✔ You protect your investments

An emergency fund gives you peace of mind.

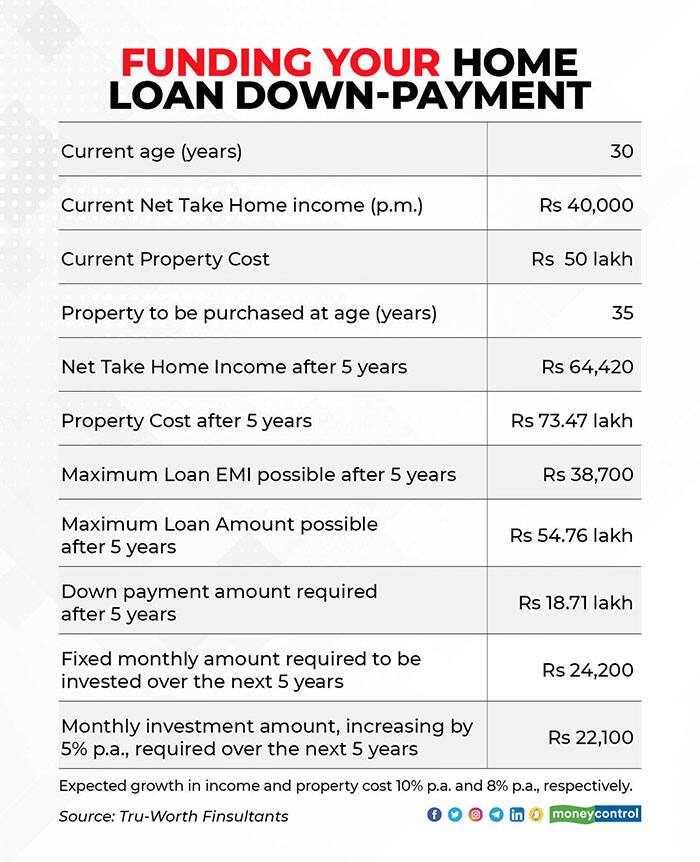

🔹 Step 1: Set a Realistic Emergency Fund Goal

The general rule is:

✅ Save 3–6 months of living expenses

But don’t feel overwhelmed. Start small.

Beginner-Friendly Targets:

-

$500 → First milestone

-

$1,000 → Strong start

-

3 months of expenses → Ideal

-

6 months of expenses → Very secure

Your goal depends on:

-

Your income stability

-

Monthly expenses

-

Family size

-

Job security

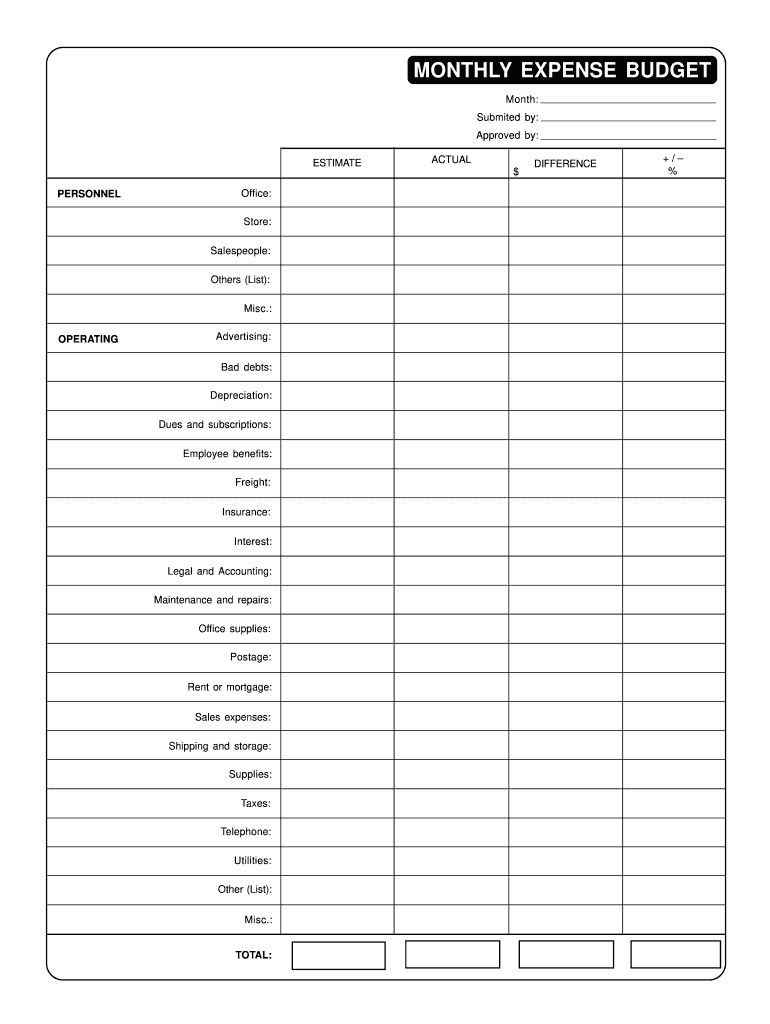

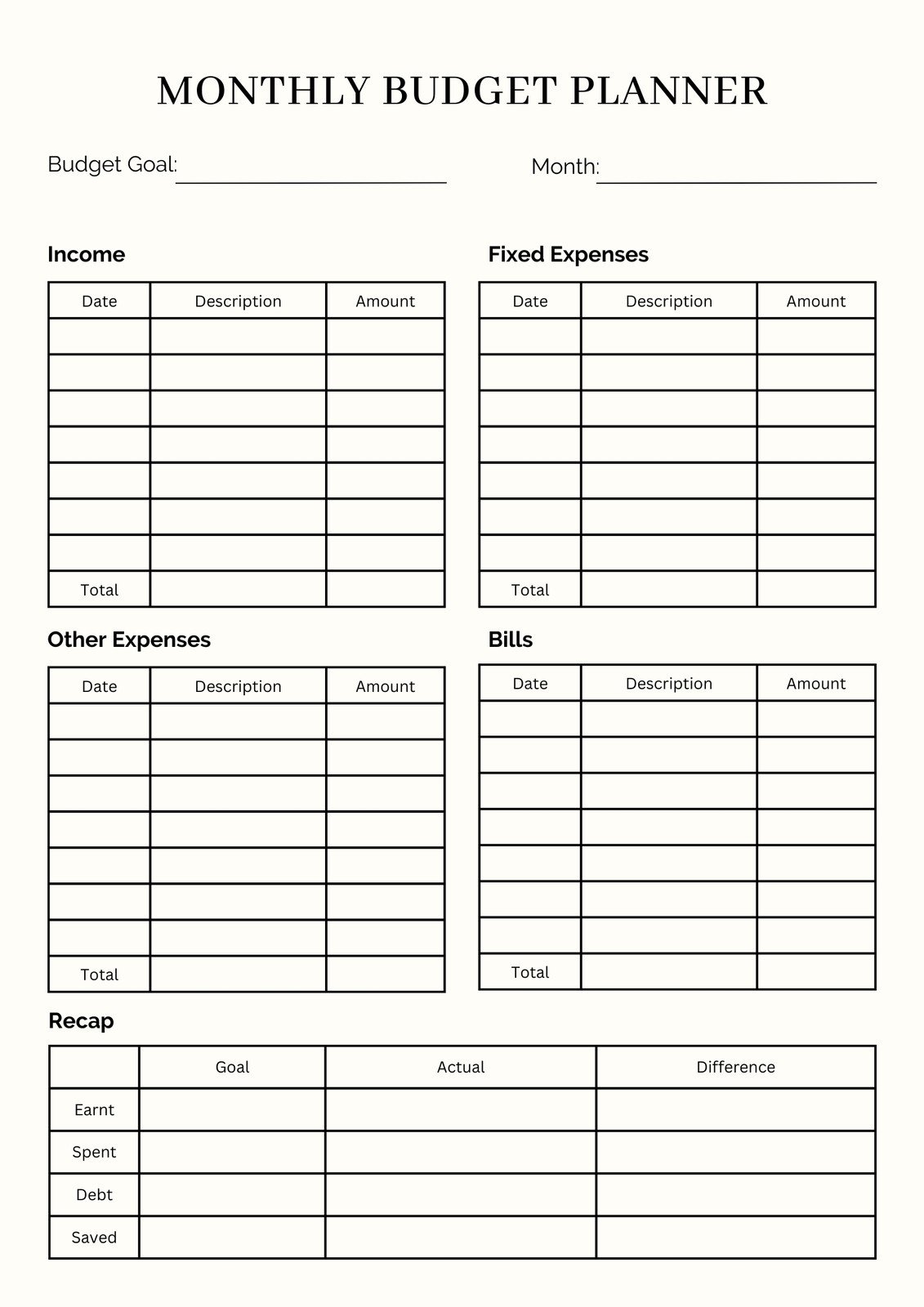

🔹 Step 2: Calculate Your Monthly Expenses

Write down all your essential monthly expenses, such as:

-

Rent or mortgage

-

Utilities

-

Food

-

Transportation

-

Phone & internet

-

Insurance

💡 Example:

If your monthly expenses = $1,000

Then:

-

3-month fund = $3,000

-

6-month fund = $6,000

This becomes your emergency fund target.

🔹 Step 3: Open a Separate Savings Account

Never mix emergency money with daily spending.

Your emergency fund should be:

✔ Easy to access

✔ Safe

✔ Separate from checking account

✔ Not invested in risky assets

Best options:

-

High-yield savings account

-

Separate bank savings account

Avoid:

❌ Stocks

❌ Crypto

❌ Long-term investments

Emergency money must be safe and liquid.

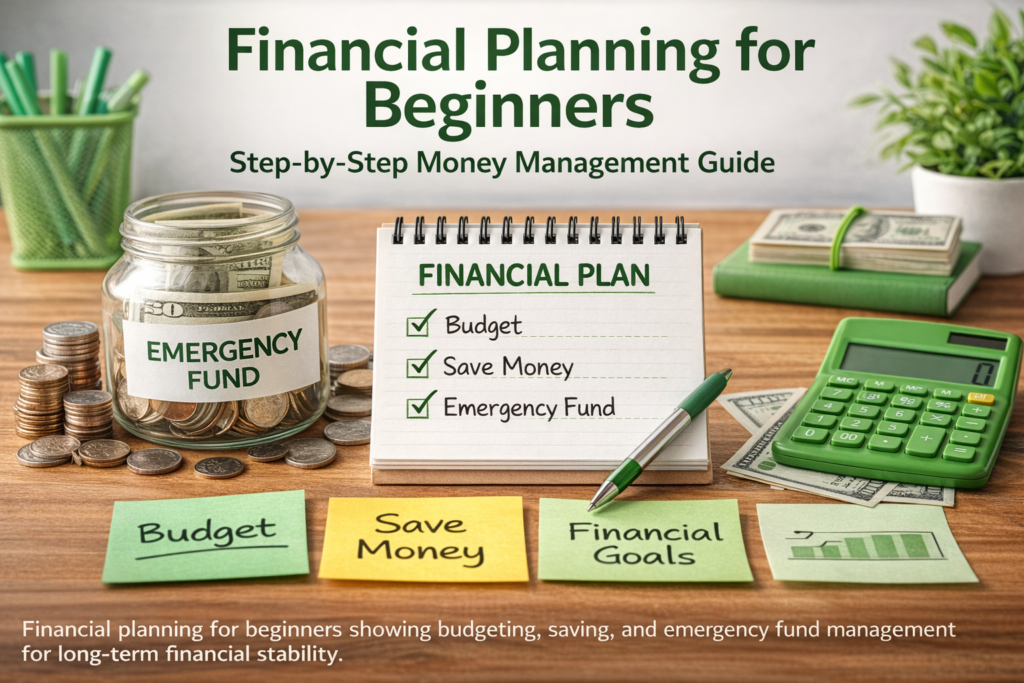

Building an emergency fund is one of the most important steps toward financial stability. Many beginners don’t realize how crucial it is until an unexpected expense appears. According to what an emergency fund is and why it matters, having money set aside helps you avoid debt and reduces financial stress during emergencies. It allows you to handle situations like medical bills or job loss without relying on credit cards or loans.

Financial experts also recommend starting small and staying consistent. As explained by how to build an emergency fund step by step, setting aside even a small amount each month can make a big difference over time and help you stay financially secure.

🔹 Step 4: Start Small and Be Consistent

You don’t need to save a lot at once.

Start with:

-

$10 per week

-

$50 per month

-

5–10% of your income

Consistency matters more than amount.

💡 Even saving $1 per day builds a habit.

How to Make a Monthly Budget (Step-by-Step Guide for Beginners)

🔹 Step 5: Cut Small Expenses to Boost Savings

Look at where your money goes each month.

Common places to save:

-

Subscriptions you don’t use

-

Eating out frequently

-

Impulse shopping

-

Expensive coffee habits

Redirect that money into your emergency fund.

Small changes = big results over time.

🔹 Step 6: Automate Your Savings

The easiest way to save is to automate it.

Set up:

✔ Automatic transfers

✔ Weekly or monthly deposits

✔ Fixed savings amount

When saving happens automatically, you’re less likely to skip it.

🔹 Step 7: Use Extra Income to Grow Your Fund Faster

Whenever you receive:

-

Bonus

-

Tax refund

-

Side income

-

Gift money

Put a portion into your emergency fund.

This can help you reach your goal much faster without affecting daily expenses.

🔹 Step 8: Don’t Touch It Unless It’s an Emergency

Your emergency fund is not for:

❌ Shopping

❌ Vacations

❌ Gadgets

❌ Wants

Use it only for:

✔ Medical emergencies

✔ Job loss

✔ Essential repairs

✔ True financial emergencies

This discipline is what makes the fund effective.

🔹 Step 9: Refill the Fund After Using It

If you ever use your emergency fund, make it a priority to rebuild it.

Treat it like a bill that must be paid back.

This keeps you financially secure long-term.

🔹 Step 10: Maintain and Review Your Fund Yearly

As your income or expenses change, your emergency fund should grow too.

Review it:

-

Once a year

-

After a major life change

-

When income increases

Your financial safety net should grow with you.

🌟 Final Thoughts

Building an emergency fund is one of the smartest financial decisions you’ll ever make.

It:

-

Protects you from debt

-

Reduces stress

-

Gives financial confidence

-

Helps you stay in control

You don’t need a lot of money to start — just a plan and consistency.

Start today. Even small steps lead to big security.

Pingback: Financial Planning for Beginners: A Step-by-Step Guide to Managing Money Wisely - Nxtainews