Financial planning is one of the most important life skills — yet most people never learn it properly. Without a plan, money disappears quickly, savings stay low, and financial stress increases.

The good news?

You don’t need to be rich or a finance expert to start financial planning. You just need a simple system, consistency, and the right mindset.

In this guide, you’ll learn financial planning for beginners step by step, explained in simple language that anyone can follow.

🔹 What Is Financial Planning?

Financial planning is the process of managing your money to achieve your life goals. It helps you:

-

Control your spending

-

Save money regularly

-

Prepare for emergencies

-

Avoid debt

-

Build long-term wealth

Simply put, financial planning tells your money where to go instead of wondering where it went.

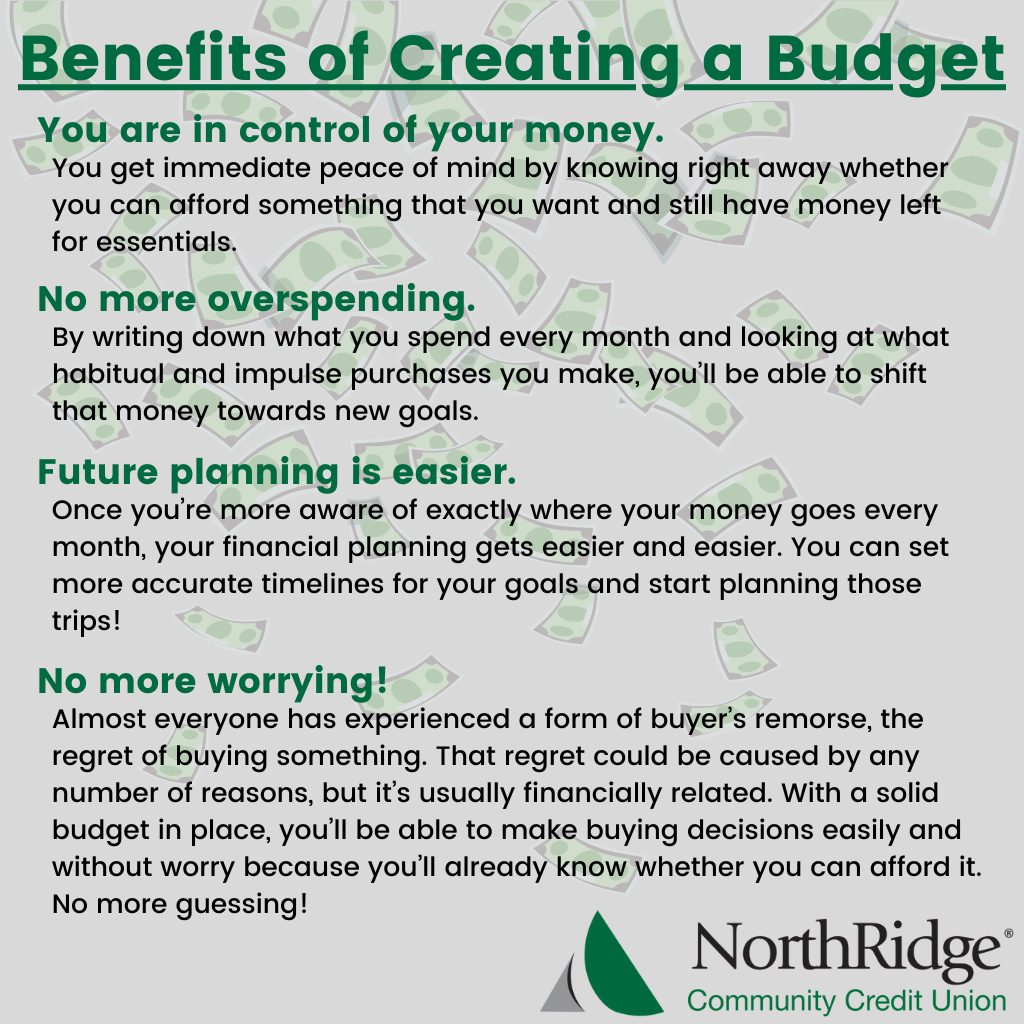

🔹 Why Financial Planning Is Important

Without financial planning:

-

Expenses increase

-

Savings stay low

-

Debt grows

-

Stress increases

With financial planning:

✔ You feel in control

✔ You save consistently

✔ You prepare for emergencies

✔ You build financial confidence

Financial planning is not about being rich — it’s about being prepared.Learning the basics of money management early can prevent financial stress later in life. Resources like USA.gov’s financial planning guide provide helpful information for beginners who want to improve their financial habits.

How to Build an Emergency Fund (Step-by-Step Guide for Beginners)

🔹 Step 1: Know Your Income and Expenses

The first step is understanding your cash flow.

✔ Calculate Your Income

Include:

-

Salary

-

Freelance income

-

Business income

-

Any fixed monthly income

✔ List Your Expenses

Divide them into:

-

Fixed expenses (rent, bills, EMI)

-

Variable expenses (food, travel, shopping)

-

Occasional expenses (repairs, medical)

Knowing this gives you clarity and control.

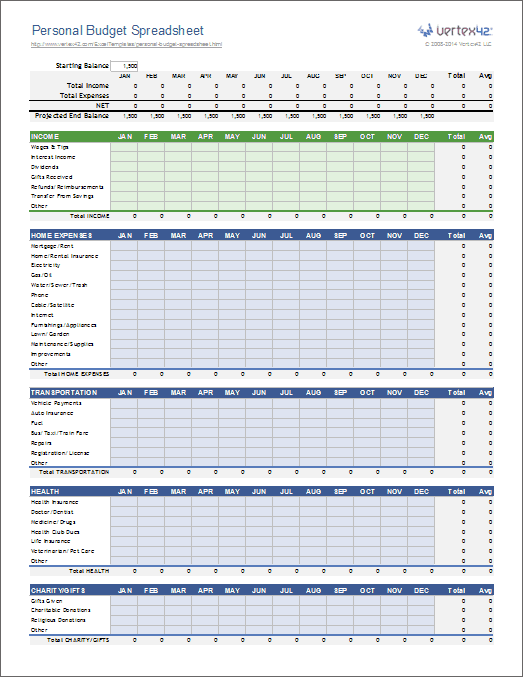

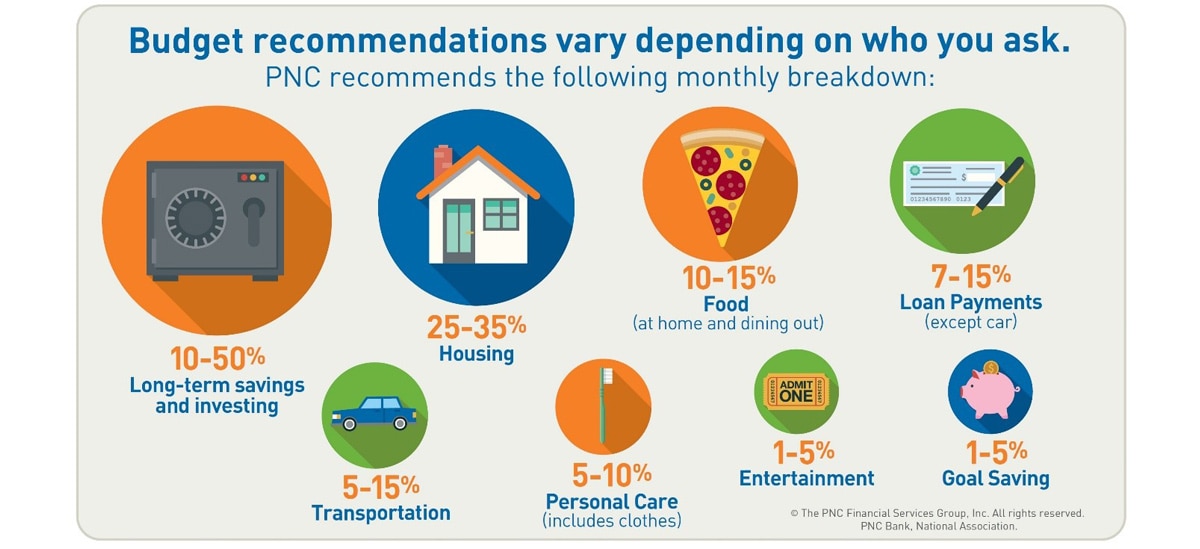

🔹 Step 2: Create a Monthly Budget

A budget helps you decide how to spend your money wisely.

Simple Budget Rule (50/30/20):

-

50% – Needs

-

30% – Wants

-

20% – Savings

This method works well for beginners and keeps finances balanced.Building a budget is one of the most important steps in financial planning. The Consumer Financial Protection Bureau recommends creating a simple budget to track income, control spending, and build savings over time

🔹 Step 3: Build an Emergency Fund

An emergency fund protects you during unexpected situations like:

-

Medical emergencies

-

Job loss

-

Urgent repairs

How much should you save?

Start with:

-

$500 → beginner goal

-

3 months of expenses → ideal

-

6 months → very secure

Keep this money in a separate savings account.

🔹 Step 4: Control Spending Habits

Small spending habits make a big difference.

Reduce:

-

Unused subscriptions

-

Frequent eating out

-

Impulse shopping

-

Unnecessary online purchases

Track your expenses weekly to stay aware.

🔹 Step 5: Start Saving and Investing Early

Saving is important — but investing helps your money grow.

Beginner-Friendly Options:

-

Savings account

-

Index funds

-

Mutual funds

-

Retirement accounts

The earlier you start, the more your money grows through compound interest.

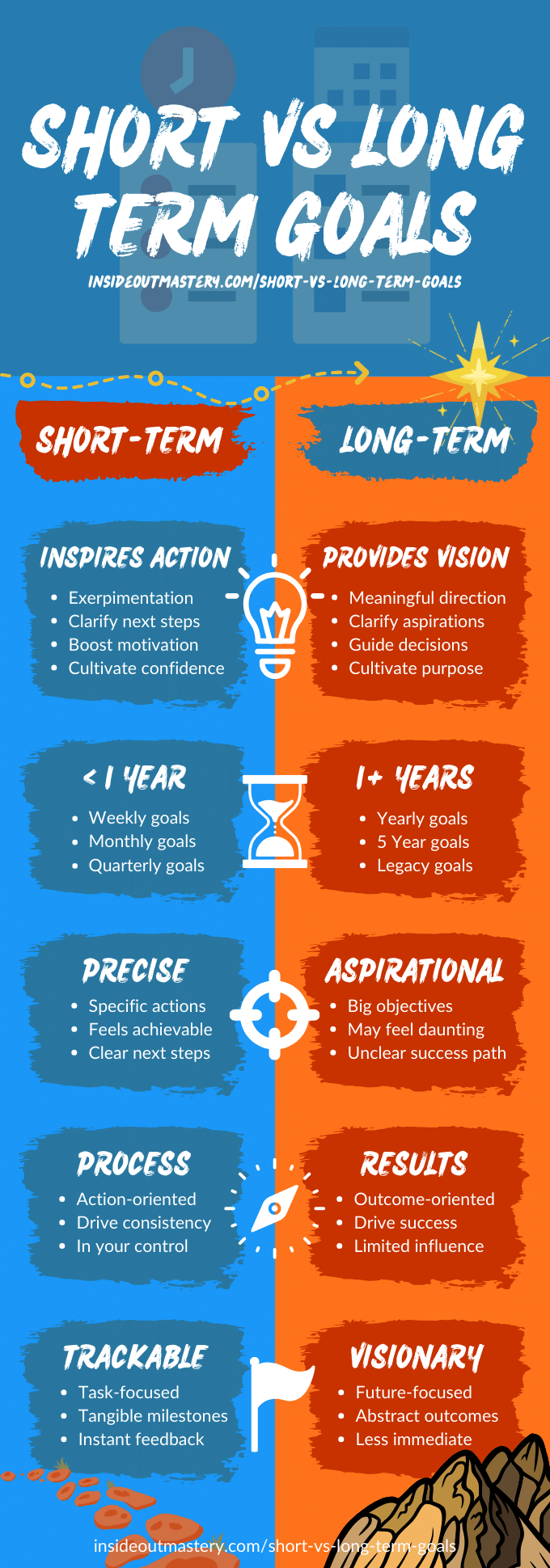

🔹 Step 6: Set Clear Financial Goals

Set goals that are:

-

Short-term (1 year)

-

Medium-term (3–5 years)

-

Long-term (retirement, house)

Having clear goals keeps you motivated and focused.

🔹 Step 7: Avoid Debt and Manage Loans Wisely

Debt can destroy financial progress if not managed carefully.

Tips:

-

Avoid unnecessary loans

-

Pay credit cards on time

-

Never spend more than you earn

-

Pay high-interest debt first

Good financial planning reduces dependence on debt.

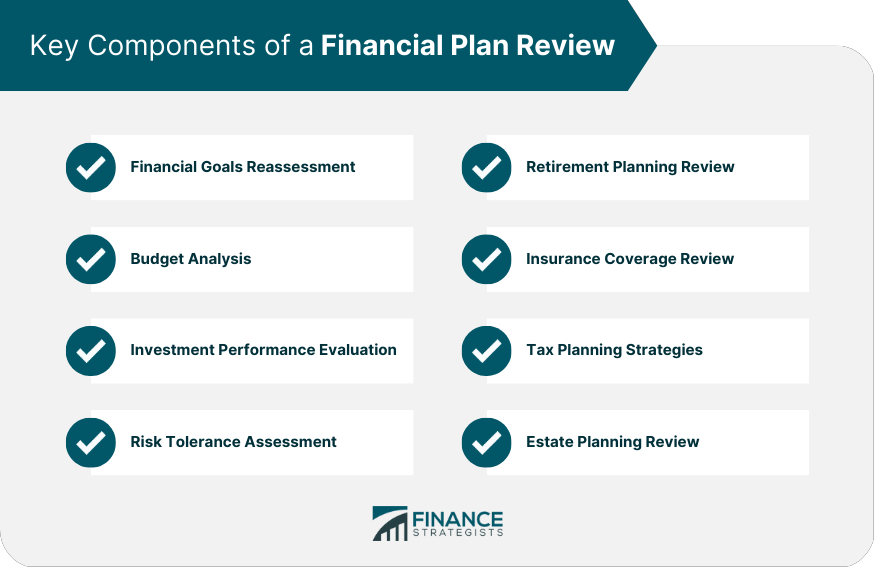

🔹 Step 8: Track Progress and Review Monthly

Once a month:

-

Review spending

-

Adjust budget

-

Increase savings if possible

-

Track financial goals

Financial planning is an ongoing process, not a one-time task.

🔹 Step 9: Improve Financial Knowledge

The more you learn, the better decisions you make.

Learn about:

-

Budgeting

-

Saving strategies

-

Investments

-

Insurance

-

Retirement planning

Knowledge protects you from financial mistakes.

🔹 Step 10: Stay Consistent and Patient

Financial success doesn’t happen overnight.

What matters:

✔ Consistency

✔ Discipline

✔ Patience

✔ Smart decisions

Small actions today lead to big results tomorrow.

🌟 Final Thoughts

Financial planning is the foundation of a stress-free and secure life.

You don’t need to earn more — you need to manage better.

Start small. Stay consistent.

Your future self will thank you.

Pingback: How to Study Effectively: Real Study Techniques That Actually Work - Nxtainews

Pingback: Time Management Tips for Students: How to Study Smarter and Use Time Wisely - Nxtainews